How to Calculate Your Annual Salary: A Simple Guide

Calculating your annual salary can be a daunting task, but it is an essential step in understanding your income and budgeting for your expenses. Whether you are a salaried employee or paid hourly, knowing your annual salary can help you plan for the future and make informed financial decisions.

To calculate your annual salary, it is important to understand the difference between salary and hourly pay. A salary is a fixed amount of money paid to an employee on a regular basis, typically annually, regardless of the number of hours worked. Hourly pay, on the other hand, is based on the number of hours worked and the hourly rate of pay. Understanding which payment structure applies to you is the first step in calculating your annual salary.

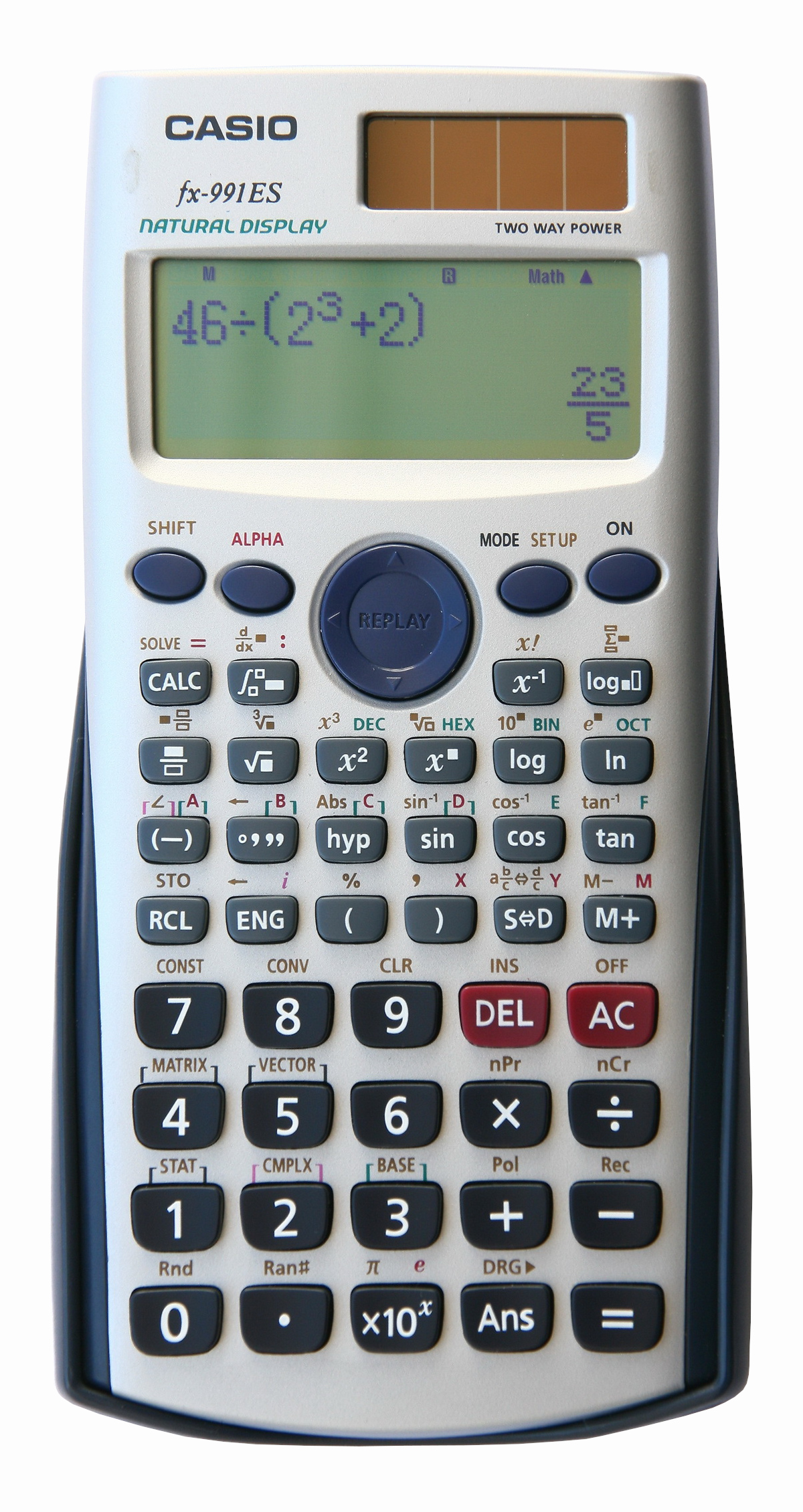

Once you know whether you are paid a salary or hourly, you can use various tools and formulas to calculate your annual salary. These include online calculators, spreadsheets, and manual calculations. By taking the time to calculate your annual salary, you can gain a better understanding of your income and make informed financial decisions for your future.

Understanding Annual Salary

Definition of Annual Salary

Annual salary refers to the total amount of money an employee is paid in a year by their employer in exchange for their services. It is usually expressed in terms of gross pay, which is the total amount of money before any taxes or deductions are taken out.

Annual salary can be calculated based on different pay periods, such as hourly, weekly, bi-weekly, or monthly. To calculate the annual salary, one needs to multiply the gross pay by the number of pay periods in a year. For example, if an employee is paid $2,000 bi-weekly, their annual salary would be $52,000 ($2,000 x 26).

Components of Annual Salary

The components of annual salary vary depending on the employer and the job position. Generally, annual salary includes the base pay, which is the fixed amount of money an employee is paid for their regular work hours. In addition to the base pay, employees may receive additional compensation, such as bonuses, commissions, or overtime pay.

Bonuses are one-time payments given to employees as a reward for their performance or as an incentive to achieve specific goals. Commissions are payments based on a percentage of the sales an employee generates. Overtime pay is additional pay given to employees who work more than their regular work hours.

It is important to note that annual salary does not include other benefits that an employee may receive, such as health insurance, retirement plans, or paid time off. These benefits are usually calculated separately and added to the total compensation package.

In conclusion, understanding annual salary is crucial for both employees and employers. By knowing the components of annual salary, employees can negotiate their compensation package and ensure that they are being paid fairly. Employers, on the other hand, can use annual salary as a tool to attract and retain talented employees.

Calculating Annual Salary from Hourly Wage

Determining Hourly Rate

To calculate annual salary from hourly wage, the first step is to determine the hourly rate. This can be done by dividing the total amount earned in a pay period by the number of hours worked during that period. For example, if an employee earns $1,500 every two weeks and works 80 hours during that time, their hourly rate would be $18.75 ($1,500/80).

It’s important to note that the hourly rate may vary depending on factors such as overtime pay, shift differentials, and bonuses. In these cases, it may be necessary to calculate the hourly rate separately for each pay period and then determine an average hourly rate.

Annualizing the Hourly Wage

Once the hourly rate has been determined, the next step is to annualize it to calculate the annual salary. This can be done by multiplying the hourly rate by the number of hours worked per year. The standard number of hours worked per year is typically considered to be 2,080, which is calculated by multiplying the number of workdays in a year (usually 260) by the number of hours worked per day (usually 8).

For example, if an employee’s hourly rate is $18.75 and they work 2,080 hours per year, their annual salary would be $39,000 ($18.75 x 2,080). It’s important to note that this figure represents the employee’s pre-tax income. Taxes and other deductions will need to be taken into account when calculating the employee’s net income.

In summary, calculating annual salary from hourly wage involves determining the hourly rate by dividing the total amount earned in a pay period by the number of hours worked, and then annualizing the hourly rate by multiplying it by the number of hours worked per year. By following these steps, employees can get a better understanding of their annual income and plan their finances accordingly.

Calculating Annual Salary from Monthly Wage

Determining Monthly Rate

To calculate annual salary from monthly wage, the first step is to determine the monthly rate. This can be done by dividing the monthly wage by the number of months in a year. For example, if an employee earns $3,000 per month, the monthly rate would be $3,000 ÷ 12 = $250.

Annualizing the Monthly Wage

Once the monthly rate has been determined, the next step is to annualize it. To do this, simply multiply the monthly rate by the number of months in a year. For example, if the monthly rate is $250, the annual salary would be $250 × 12 = $3,000.

It is important to note that this method assumes that the employee is paid the same amount each month. If an employee’s salary varies from month to month, the calculation would need to be adjusted accordingly. Additionally, this method does not take into account any bonuses or other forms of compensation that may be paid out over the course of the year.

By following these simple steps, anyone can easily calculate their annual salary from their monthly wage. This information can be useful when negotiating salaries, budgeting, or planning for the future.

Incorporating Overtime Pay

Understanding Overtime Regulations

Overtime is the additional compensation paid to an employee for working more than the standard hours set by the employer or the law. In the United States, the Fair Labor Standards Act (FLSA) mandates that non-exempt employees who work more than 40 hours in a workweek must be paid one and a half times their regular hourly rate for every hour worked over 40 hours.

It’s important to note that not all employees are entitled to overtime pay. Exempt employees, such as executives, administrative, and professional employees, are exempt from overtime pay. It’s crucial to understand your job classification and the overtime regulations that apply to you to ensure that you’re receiving the correct compensation.

Calculating Overtime Impact on Annual Salary

Calculating your annual salary with overtime pay can be tricky, but it’s essential to understand how your overtime hours impact your total salary. To calculate your annual salary with overtime pay, you need to follow these steps:

- Determine your regular hourly rate: Divide your weekly salary by the total number of hours you worked in a week. For example, if your weekly salary is $1,000, and you worked 40 hours in a week, your regular hourly rate is $25 ($1,000/40 hours).

- Determine your overtime hourly rate: Multiply your regular hourly rate by 1.5. For example, if your regular hourly rate is $25, your overtime hourly rate is $37.50 ($25 x 1.5).

- Calculate your overtime pay: Multiply your overtime hourly rate by the number of overtime hours you worked. For example, if you worked 5 overtime hours, your overtime pay is $187.50 ($37.50 x 5).

- Add your overtime pay to your regular pay: Add your regular pay to your overtime pay to get your total pay. For example, if your regular pay is $1,000, and your overtime pay is $187.50, your total pay is $1,187.50.

To calculate your annual salary with overtime pay, multiply your total pay by the number of weeks you worked in a year. For example, if you worked 52 weeks in a year, your annual salary with overtime pay is $61,750 ($1,187.50 x 52 weeks).

Incorporating overtime pay into your annual salary calculation can significantly impact your total compensation. It’s essential to understand the overtime regulations that apply to you and accurately calculate your annual salary to ensure that you’re receiving the correct compensation for your work.

Accounting for Bonuses and Commissions

Understanding Variable Pay

Variable pay, also known as performance-based pay, is a form of compensation that varies based on an employee’s performance or achievements. This type of pay includes bonuses, commissions, and profit-sharing. Variable pay is often used to incentivize employees to work harder and achieve specific goals.

Incorporating Bonuses and Commissions

When calculating your annual salary, it’s important to account for any bonuses or commissions you may receive. To do this, you’ll need to determine the frequency of the payments and the amount you can expect to receive.

For example, if you receive a monthly commission based on your sales, you’ll need to calculate the average amount you earn per month and add it to your base salary. If you receive an annual bonus, you’ll need to divide the total amount by 12 and add it to your monthly salary.

It’s important to note that bonuses and commissions are typically subject to taxes. The tax rate may vary depending on the type of bonus or commission and the state you live in. For example, in Georgia, bonus pay tax rates are determined by the employee’s annual salary.

To ensure accuracy, it’s recommended that you use a payroll Calculator City; blog, to determine your total compensation, including bonuses and commissions. This will give you a clear understanding of your annual salary and help you plan your finances accordingly.

Incorporating bonuses and commissions into your annual salary calculation can be a bit tricky, but it’s an important step in understanding your total compensation. By taking the time to accurately calculate your variable pay, you can ensure that you’re getting paid what you’re worth and plan for a financially stable future.

Adjusting for Paid Time Off

Calculating PTO and Holidays

When calculating annual salary, it is important to consider paid time off (PTO) and holidays. PTO is the time that an employee takes off work while still receiving their regular pay. This can include vacation days, sick days, and personal days. Holidays are days when the company is closed, but the employee is still paid.

To calculate PTO and holiday pay, start by determining the number of days the employee is entitled to. This can be found in the employee’s contract or employee handbook. Once the number of days is determined, multiply it by the employee’s daily rate of pay. For example, if an employee is entitled to 10 days of PTO and their daily rate of pay is $200, their PTO pay would be $2,000.

Impact of PTO on Annual Salary

PTO can impact an employee’s annual salary. When an employee takes PTO, they are not working and therefore not earning their regular pay. This means that their annual salary will be lower than if they had worked every day of the year.

To calculate the impact of PTO on an employee’s annual salary, start by determining the number of days the employee is entitled to. Then, multiply that number by the employee’s daily rate of pay. Finally, subtract that amount from the employee’s annual salary. For example, if an employee is entitled to 10 days of PTO and their daily rate of pay is $200, their PTO pay would be $2,000. If their annual salary is $50,000, their adjusted annual salary would be $48,000 ($50,000 – $2,000).

It is important for both employers and employees to understand the impact of PTO on annual salary. Employers should ensure that they are accurately calculating PTO and holiday pay, and employees should be aware of how taking time off can impact their annual salary.

Benefits and Deductions

Healthcare and Retirement Plans

Many employers offer healthcare and retirement plans as part of their benefits package. These plans can have a significant impact on an employee’s take-home pay and overall financial well-being.

Healthcare plans typically come with a monthly premium that is deducted from an employee’s paycheck. In some cases, the employer may cover part or all of the premium. Additionally, the employee may have to pay a deductible or copay when receiving medical services.

Retirement plans, such as 401(k) or IRA, allow employees to save for their future by contributing a portion of their paycheck to a retirement account. Some employers may also offer matching contributions up to a certain percentage. These contributions are made pre-tax, which means they reduce the employee’s taxable income and can result in a lower tax bill.

Tax Withholdings and Other Deductions

Employers are required to withhold taxes from an employee’s paycheck, including federal income tax, Social Security tax, and Medicare tax. The amount of tax withheld depends on the employee’s income, filing status, and number of allowances claimed on their W-4 form.

In addition to taxes, there may be other deductions taken out of an employee’s paycheck, such as for health insurance, life insurance, or union dues. These deductions can vary depending on the employer and the employee’s individual circumstances.

It’s important for employees to review their paycheck stubs regularly to ensure that they are being paid correctly and that all deductions are accurate. If there are any discrepancies, employees should bring them to their employer’s attention as soon as possible.

Overall, understanding the benefits and deductions that come with a job can help employees make informed decisions about their finances and plan for their future.

Comparing Salaries

Regional Salary Variations

When comparing salaries, it is important to take into account regional variations. Salaries can vary significantly from one region to another due to differences in the cost of living, taxes, and other factors. For example, a salary of $60,000 in New York City may not be the same as a salary of $60,000 in a smaller city with a lower cost of living.

To get a better idea of how salaries vary by region, job seekers can use online salary calculators that take into account factors such as location, job title, and experience. Websites like Salary.com and Glassdoor offer free salary calculators that can help job seekers compare salaries across different regions.

Industry Standards

In addition to regional variations, salaries can also vary significantly by industry. Different industries have different standards when it comes to salaries, and it is important for job seekers to be aware of these standards when negotiating their salaries.

For example, salaries in the technology industry are generally higher than salaries in the retail industry. Similarly, salaries in the healthcare industry are generally higher than salaries in the hospitality industry. Job seekers can use online resources such as PayScale to research industry standards and get a better idea of what they can expect to earn in their chosen field.

By taking into account both regional variations and industry standards, job seekers can get a better idea of what they can expect to earn in their chosen field and negotiate salaries more effectively.

Negotiating Salary

Negotiating salary can be a daunting task for many employees, but it is an important part of the job offer process. By negotiating, employees can ensure that they are being paid fairly for their skills and experience. Here are some tips for negotiating salary effectively:

Preparation for Negotiation

Before entering into salary negotiations, employees should do their research. They should know what the average salary is for their position and experience level in their industry and location. This information can be found through online research, speaking with colleagues, or using salary comparison tools. Armed with this information, employees can set a realistic salary range for themselves.

Employees should also consider their own strengths and accomplishments when negotiating salary. They should be able to articulate their value to the company and how their skills and experience make them an asset. This can help them negotiate a higher salary.

Effective Negotiation Strategies

When negotiating salary, employees should keep in mind that it is a conversation, not a confrontation. They should be confident, but also respectful and professional. Here are some effective negotiation strategies:

-

Start with a higher number: Employees should start with a salary slightly higher than what they are willing to accept. This gives them room to negotiate down to their desired salary.

-

Focus on total compensation: Employees should consider negotiating other aspects of their compensation package, such as benefits, vacation time, and bonuses. This can be a way to increase their overall compensation without increasing their salary.

-

Be willing to compromise: Negotiation is about finding a mutually beneficial solution. Employees should be willing to compromise on some aspects of their salary or compensation package in order to reach an agreement.

-

Practice active listening: Employees should listen carefully to the employer’s response and ask questions to clarify any points of confusion. This can help them understand the employer’s perspective and find common ground.

By following these tips, employees can negotiate their salary with confidence and achieve a fair compensation package.

Frequently Asked Questions

What is the formula for converting hourly wages to annual salary?

To convert hourly wages to annual salary, you can use the following formula:

Annual Salary = Hourly Wage x Hours Worked Per Week x 52For example, if you earn $20 per hour and work 40 hours per week, your annual salary would be:

$20 x 40 x 52 = $41,600How can I determine my yearly salary from monthly earnings?

To determine your yearly salary from monthly earnings, you can use the following formula:

Annual Salary = Monthly Salary x 12For example, if you earn $3,000 per month, your annual salary would be:

$3,000 x 12 = $36,000What method should I use to calculate my total annual compensation?

To calculate your total annual compensation, you should consider all of the benefits and perks that you receive in addition to your salary. This may include bonuses, stock options, health insurance, retirement plans, and other benefits. You can add up the value of these benefits and add them to your annual salary to calculate your total annual compensation.

How do you figure out your yearly income from a bi-weekly paycheck?

To figure out your yearly income from a bi-weekly paycheck, you can use the following formula:

Annual Income = Bi-Weekly Pay x 26For example, if you earn $1,500 per bi-weekly paycheck, your annual income would be:

$1,500 x 26 = $39,000Can you explain how to calculate gross annual salary from net pay?

To calculate gross annual salary from net pay, you can use the following formula:

Gross Annual Salary = Net Annual Salary / (1 - Tax Rate)For example, if your net annual salary is $50,000 and your tax rate is 20%, your gross annual salary would be:

$50,000 / (1 - 0.20) = $62,500What steps are involved in calculating average annual salary over multiple years?

To calculate your average annual salary over multiple years, you should add up your total income for each year and divide by the number of years. For example, if you earned $40,000 in year one and $50,000 in year two, your total income would be $90,000. To calculate your average annual salary over two years, you would divide $90,000 by 2, resulting in an average annual salary of $45,000.