How to Calculate Cost Savings: A Clear and Confident Guide

Calculating cost savings is an essential skill for individuals and businesses alike. Cost savings can be achieved through various means, including reducing expenses or increasing efficiency. Regardless of the method used, calculating cost savings is crucial to determine the effectiveness of cost-saving measures.

To calculate cost savings, one must first determine the baseline costs. This refers to the original cost before any changes were made. Next, the cost reduction percentage needs to be calculated. This percentage represents the amount by which the costs were reduced. Finally, the cost savings percentage can be calculated by dividing the cost reduction by the baseline costs and multiplying by 100. This percentage represents the overall savings achieved.

Whether you are a business owner looking to cut costs or an individual trying to save money, understanding how to calculate cost savings is essential. By following the steps outlined above and utilizing the appropriate tools, individuals and businesses can accurately determine their cost savings and make informed decisions about future cost-saving measures.

Understanding Cost Savings

Definition and Importance

Cost savings is a crucial aspect of any business operation. It refers to the reduction of expenses incurred by a company while maintaining the same level of productivity. By reducing costs, businesses can increase their profitability and improve their bottom line. Cost savings can be achieved by implementing cost-cutting measures, negotiating better deals with suppliers, and optimizing processes.

One important thing to note is that cost savings should not be confused with cost avoidance. Cost avoidance refers to the prevention of unnecessary expenses, while cost savings refer to the reduction of actual expenses. Both cost savings and cost avoidance are important for businesses, but they are different concepts.

Types of Cost Savings

There are several types of cost savings that businesses can achieve. These include:

-

Raw Material Cost Savings: This refers to the reduction of costs associated with the purchase of raw materials. Raw material cost savings can be achieved by negotiating better deals with suppliers, finding alternative suppliers, or optimizing the use of raw materials.

-

Labor Cost Savings: This refers to the reduction of labor costs associated with the production process. Labor cost savings can be achieved by optimizing the production process, reducing the number of employees, or outsourcing certain tasks.

-

Energy Cost Savings: This refers to the reduction of energy costs associated with the operation of a business. Energy cost savings can be achieved by implementing energy-efficient measures, such as using energy-efficient equipment or optimizing the use of lighting and heating.

-

Overhead Cost Savings: This refers to the reduction of overhead costs associated with running a business. Overhead cost savings can be achieved by reducing rent costs, implementing cost-cutting measures, or finding alternative suppliers for services such as IT support.

In conclusion, cost savings is an important aspect of any business operation. By understanding the different types of cost savings and implementing cost-cutting measures, businesses can increase their profitability and improve their bottom line.

Calculating Cost Savings

Calculating cost savings is a crucial step in determining the efficiency of an organization’s cost-cutting measures. This section will outline the steps involved in calculating cost savings, including identifying baseline costs, measuring actual expenditures, and determining the savings.

Identifying Baseline Costs

The first step in calculating cost savings is to identify the baseline costs. This involves determining the costs associated with a particular process or activity before any cost-cutting measures are implemented. Baseline costs can be obtained by reviewing financial records, invoices, and other documents related to the process or activity.

Measuring Actual Expenditures

The next step is to measure the actual expenditures after the cost-cutting measures have been implemented. This involves tracking the costs associated with the process or activity and comparing them to the baseline costs. Actual expenditures can be obtained by reviewing financial records, invoices, and other documents related to the process or activity.

Determining the Savings

The final step is to determine the savings achieved through the cost-cutting measures. This involves subtracting the actual expenditures from the baseline costs and expressing the result as a percentage. The formula for calculating cost savings percentage is:

Cost Savings Percentage = ((Baseline Costs - Actual Expenditures) / Baseline Costs) x 100For example, if the baseline costs for a process were $50,000 and the actual expenditures after implementing cost-cutting measures were $40,000, the cost savings percentage would be:

((50,000 - 40,000) / 50,000) x 100 = 20%In this example, the cost-cutting measures resulted in a 20% cost savings for the organization.

Overall, calculating cost savings is an important process for any organization looking to improve its efficiency and reduce costs. By following the steps outlined in this section, organizations can accurately measure the impact of their cost-cutting measures and make informed decisions about future cost-saving initiatives.

Methods for Cost Savings Analysis

When it comes to calculating cost savings, there are several methods businesses can use. In this section, we will discuss the three most common methods: Simple Subtraction Method, Return on Investment (ROI) Analysis, and Total Cost of Ownership (TCO).

Simple Subtraction Method

The Simple Subtraction Method is the most straightforward way to calculate cost savings. It involves subtracting the cost of the old process or system from the cost of the new process or system. The result is the cost savings.

For example, if a company was spending $10,000 a year on paper invoices and switched to an electronic invoicing system that costs $5,000 a year, the cost savings would be $5,000.

Return on Investment (ROI) Analysis

ROI analysis is a more comprehensive method for calculating cost savings. It takes into account the initial investment, ongoing costs, and expected returns. The formula for ROI is:

ROI = (Net Profit / Cost of Investment) x 100

Net Profit is the total amount of money saved or earned from the investment, and Cost of Investment is the total cost of the investment.

For example, if a company invested $100,000 in a new software system that saved them $50,000 a year, the ROI would be:

ROI = ($50,000 / $100,000) x 100 = 50%

Total Cost of Ownership (TCO)

TCO is a method for calculating the total cost of a system or process over its lifetime. It takes into account all costs associated with the system or process, including initial investment, maintenance, and operating costs.

To calculate TCO, businesses should consider all costs associated with the system or process and estimate the total cost over its lifetime. This includes costs such as hardware, software, training, maintenance, and upgrades.

Using TCO can help businesses make more informed decisions about which system or process to implement, as it takes into account all costs associated with the system or process over its lifetime.

In conclusion, businesses have several methods available to calculate cost savings. The Simple Subtraction Method is the most straightforward, while ROI and TCO provide more comprehensive analyses. By using these methods, businesses can make informed decisions about which systems or processes to implement to achieve cost savings.

Factors Affecting Cost Savings

Calculating cost savings is an essential aspect of managing expenses and optimizing financial efficiency. However, there are several factors that can impact the amount of cost savings a business can achieve. In this section, we will discuss some of the factors that affect cost savings.

Market Conditions

Market conditions can have a significant impact on the cost savings a business can achieve. For example, if the market is highly competitive, businesses may be able to negotiate better prices with suppliers, leading to lower costs and higher cost savings. Conversely, if the market is less competitive, businesses may have less bargaining power, which can limit their ability to negotiate lower prices.

Operational Efficiencies

Operational efficiencies can also impact cost savings. By streamlining processes and reducing waste, businesses can lower their costs and achieve higher cost savings. For example, implementing a lean manufacturing process can help businesses reduce waste and improve efficiency, leading to lower costs and higher cost savings.

Volume Discounts

Volume discounts are another factor that can impact cost savings. By purchasing larger quantities of goods or services, businesses may be able to negotiate lower prices, leading to higher cost savings. However, it is important to note that volume discounts may not always be the best option, as businesses may end up with excess inventory or unused services, which can result in additional costs.

In summary, several factors can impact the amount of cost savings a business can achieve, including market conditions, operational efficiencies, and volume discounts. By understanding these factors and taking steps to optimize cost savings, businesses can improve their financial efficiency and achieve long-term success.

Implementing Cost Savings Strategies

After identifying opportunities for cost savings, the next step is to implement the strategies that will lead to cost reduction. The following are some of the most effective cost savings strategies.

Process Optimization

Process optimization involves streamlining operations to reduce costs. This can be achieved by identifying inefficiencies in the production process and implementing changes to eliminate them. For example, a company can reduce costs by automating certain tasks or by reorganizing the production line to reduce material handling.

Negotiation with Suppliers

Negotiating with suppliers is another effective way to reduce costs. Companies can negotiate better prices for raw materials, equipment, and other supplies. By doing so, they can reduce their overall expenses and increase profitability. It is important to note that negotiation should be done in a professional and respectful manner to maintain good relationships with suppliers.

Investing in Technology

Investing in technology can also help companies reduce costs. For example, implementing a new software system can automate certain tasks, reduce errors, and improve efficiency. This can lead to significant cost savings over time. It is important to carefully evaluate the costs and benefits of any technology investment to ensure that it will lead to long-term cost savings.

Overall, implementing cost savings strategies requires careful planning, execution, and evaluation. By optimizing processes, negotiating with suppliers, and investing in technology, companies can reduce their expenses and improve profitability.

Monitoring and Reporting

Once cost-saving initiatives are implemented, it is crucial to monitor and report on their progress to ensure that they are delivering the expected results. In this section, we will discuss some best practices for monitoring and reporting on cost savings.

Continuous Improvement

Continuous improvement is a key component of any cost-saving initiative. By continuously monitoring and analyzing the performance of cost-saving initiatives, organizations can identify areas where further improvements can be made and take corrective actions as necessary. This can help to ensure that cost-saving initiatives remain effective over the long term.

Performance Indicators

To effectively monitor cost savings, organizations should establish performance indicators that measure the success of cost-saving initiatives. These indicators should be specific, measurable, and relevant to the initiative being monitored. For example, if an organization is implementing a new procurement process to reduce costs, performance indicators could include the percentage of cost savings achieved, the number of suppliers consolidated, and the time it takes to complete the procurement process.

Reporting Frameworks

To ensure that cost-saving initiatives are properly monitored and reported, organizations should establish reporting frameworks that clearly define the reporting requirements and processes. Reporting frameworks should specify the frequency of reporting, the types of reports to be generated, and the audience for each report. They should also include guidelines for data collection and analysis, as well as templates for reporting.

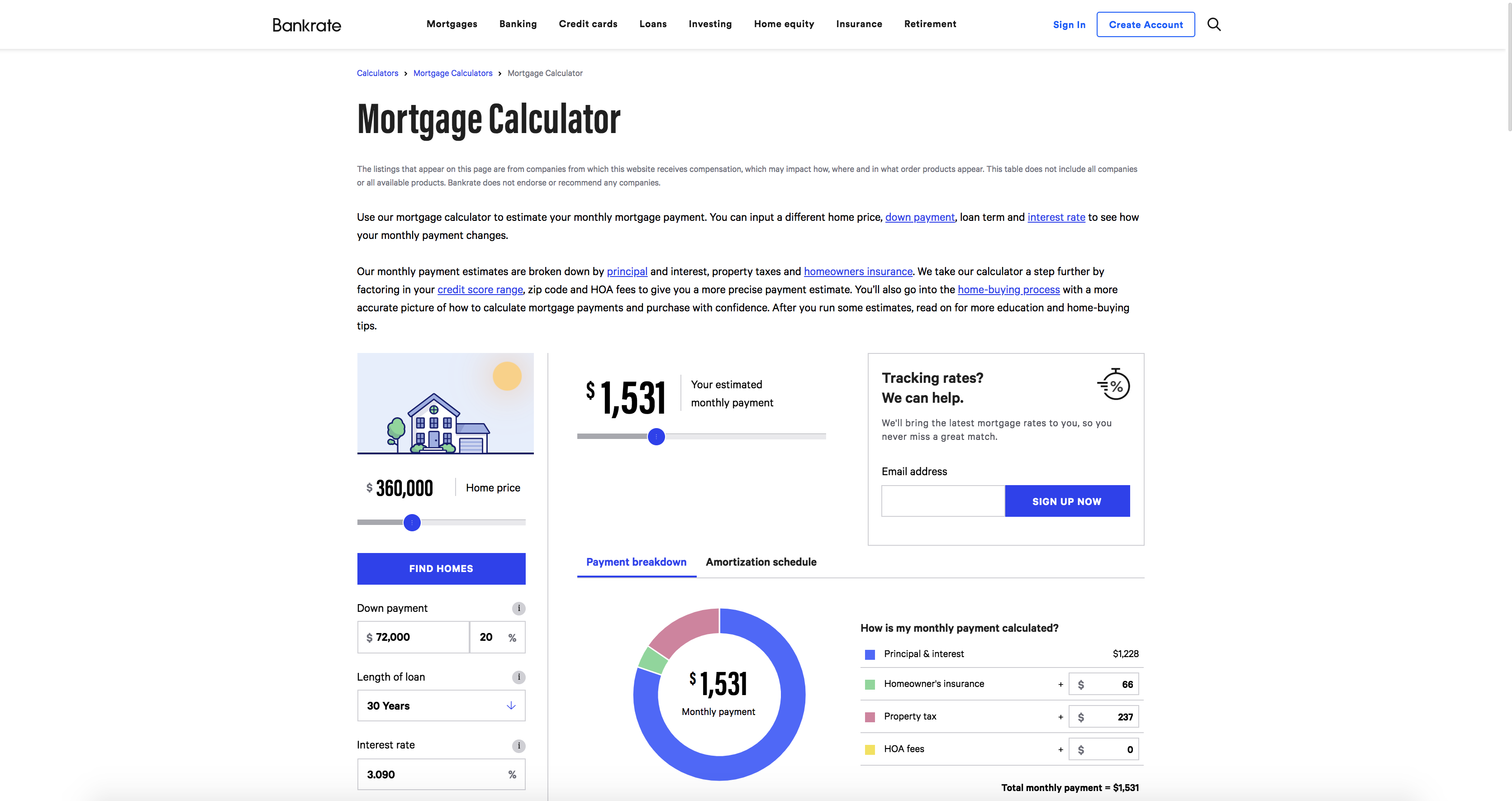

In summary, monitoring and reporting on cost-saving initiatives is essential to ensure that they are delivering the expected results. By establishing continuous improvement processes, performance indicators, and loan payment calculator bankrate reporting frameworks, organizations can effectively monitor and report on the success of cost-saving initiatives.

Case Studies on Cost Savings

Businesses of all sizes can benefit from cost savings, and there are several ways to achieve this goal. Here are a few case studies that illustrate how different companies have successfully reduced costs:

Case Study 1: Vandenberg Air Force Base

In 2008, Vandenberg Air Force Base in California implemented a lean manufacturing event that resulted in significant cost savings. The event focused on identifying real cost savings versus increased capacity and cost avoidance. The team calculated cost savings and reported them to leadership, which helped to improve the base’s financial performance.

Case Study 2: McKinsey -amp; Company

McKinsey -amp; Company is a global management consulting firm that helps businesses improve their performance. The company uses a tool called Cleansheet analysis to identify cost savings opportunities. This tool calculates the segments of a part’s cost and shows the minimum cost that can be achieved through negotiation. By using this tool, McKinsey -amp; Company has helped many clients achieve significant cost savings.

Case Study 3: LiveWell

LiveWell is a health and wellness company that was able to reduce its raw material costs by 10% through a cost-saving initiative. To achieve this goal, the company calculated its baseline costs and then implemented a plan to reduce those costs. The initiative led to a $5,000 reduction in raw material costs and a 10% cost savings.

Case Study 4: Veridion

Veridion is a procurement consulting firm that helps businesses measure cost savings in procurement. The firm uses several methods to measure cost savings, including budget savings, price variance savings, and process cost savings. By using these methods, Veridion has helped many clients achieve significant cost savings and improve their procurement processes.

In conclusion, these case studies demonstrate that cost savings can be achieved through various methods, including lean manufacturing events, Cleansheet analysis, cost-saving initiatives, and procurement consulting. By implementing these strategies, businesses can improve their financial performance and achieve their goals.

Best Practices in Cost Savings

When it comes to implementing cost-saving measures, there are a few best practices to keep in mind. By following these practices, businesses can optimize their cost-saving strategies and achieve their financial goals.

Conduct a Comprehensive Analysis

Before implementing any cost-saving measures, it is essential to conduct a comprehensive analysis of the business’s expenses. This analysis should identify areas where costs can be reduced without negatively impacting the business’s operations or the quality of its products or services.

Prioritize Cost-Saving Initiatives

Once the analysis is complete, it is important to prioritize cost-saving initiatives based on their potential impact and ease of implementation. By tackling the most impactful initiatives first, businesses can achieve significant cost savings quickly, which can then be reinvested in other areas of the business.

Create a Detailed Implementation Plan

To ensure that cost-saving initiatives are implemented effectively, it is important to create a detailed implementation plan. This plan should outline the specific steps that will be taken to implement each initiative, as well as the timeline for implementation and the expected outcomes.

Monitor Progress and Adjust as Needed

Finally, it is important to monitor progress and adjust cost-saving initiatives as needed. By regularly reviewing the results of each initiative, businesses can identify areas where further cost savings can be achieved and make adjustments to their strategies accordingly.

By following these best practices, businesses can achieve significant cost savings while ensuring that their operations remain efficient and effective.

Challenges in Cost Savings

While calculating cost savings can be a valuable exercise for any business, it is not without its challenges. Here are some of the common challenges that businesses may face when attempting to calculate cost savings:

Lack of Accurate Data

One of the biggest challenges in calculating cost savings is the lack of accurate data. Businesses may not have access to all the relevant data they need to make informed decisions about cost savings. This can lead to inaccurate calculations and unreliable results.

Difficulty in Identifying Cost Savings Opportunities

Another challenge is identifying cost savings opportunities. Businesses may struggle to identify areas where they can cut costs without impacting the quality of their products or services. This can make it difficult to achieve significant cost savings.

Resistance to Change

Resistance to change can also be a significant challenge when attempting to implement cost savings initiatives. Employees may be resistant to changes in processes or procedures, which can make it difficult to implement cost-saving measures effectively.

Short-Term Focus

Finally, a short-term focus can be a challenge when attempting to calculate cost savings. Businesses may focus too much on short-term cost savings and fail to consider the long-term impact of their decisions. This can lead to missed opportunities for significant cost savings in the long run.

Overall, while the benefits of cost savings can be significant, businesses must be aware of the challenges they may face when attempting to calculate and implement cost-saving measures. By addressing these challenges head-on, businesses can more effectively achieve their cost savings goals.

Frequently Asked Questions

What is the standard formula for calculating annual cost savings?

The standard formula for calculating annual cost savings is to subtract the current year’s cost from the previous year’s cost, then divide that number by the previous year’s cost. The result is expressed as a percentage, which represents the percentage decrease in cost from the previous year.

How do you determine cost savings in a manufacturing environment?

In a manufacturing environment, cost savings can be determined by identifying areas where costs can be reduced, such as raw materials, labor, or energy usage. Once these areas are identified, the cost savings can be calculated by comparing the current cost to the cost after the changes have been implemented.

What are the steps to calculate time-related cost savings?

To calculate time-related cost savings, first determine the hourly rate of the employee or employees whose time will be saved. Next, calculate the amount of time saved by implementing the change. Finally, multiply the hourly rate by the amount of time saved to determine the time-related cost savings.

Can you explain the difference between cost avoidance and cost savings?

Cost avoidance refers to the act of preventing costs from occurring in the first place, while cost savings refers to reducing or eliminating existing costs. Cost avoidance is generally considered to be a more proactive approach to cost management, while cost savings is a more reactive approach.

How do you calculate the percentage of cost savings using Excel?

To calculate the percentage of cost savings using Excel, subtract the new cost from the old cost, then divide that number by the old cost. Finally, multiply the result by 100 to get the percentage of cost savings.

What are some common examples of cost savings in a business context?

Common examples of cost savings in a business context include reducing energy usage, optimizing supply chain management, reducing waste, and improving efficiency in production processes. By implementing cost-saving measures, businesses can improve their bottom line and increase profitability.